RETIREMENT CALCULATOR V24.5.15.3

SCENARIO: |

|

|

OR ENTER NEW NAME | ||

SCENARIO: |

RETIREMENT CALCULATOR V24.5.15.3

SCENARIO: |

|

|

OR ENTER NEW NAME | ||

SCENARIO: |

Load data from a file!

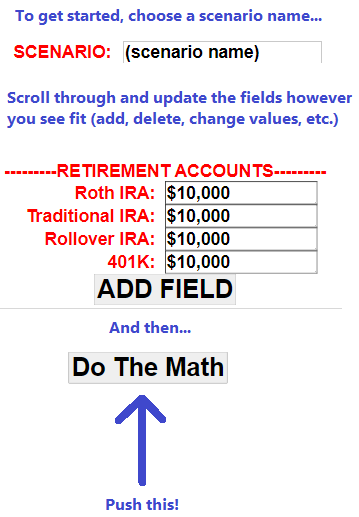

FIELD AND VALUE ENTRIES

Enter your fields and values!

YOUR NET WORTH RESULTS

Here is the Math!

Checkout the year details!

Describe your Scenario!

Field Definition Details!

Welcome to the Retirement Calculator!

This tool will allow you to test various simulations of your retirement financing model.

You can create varied scenerios, each with a unique name, and they will all save on your local device to view again later.

You can  scenerio models to a file to archive or share them with other devices.

scenerio models to a file to archive or share them with other devices.

You can  scenario models that have been saved by you or a friend or family member.

scenario models that have been saved by you or a friend or family member.

You can  to clear out everthing that was done or saved and start again fresh

to clear out everthing that was done or saved and start again fresh